Original price was: £119.99.£89.97Current price is: £89.97.

Intuit 2023 Home & Business Tax Software Download Price comparison

Intuit 2023 Home & Business Tax Software Download Price History

Intuit 2023 Home & Business Tax Software Download Description

Intuit 2023 Home & Business Tax Software Download: Your Reliable Tax Solution

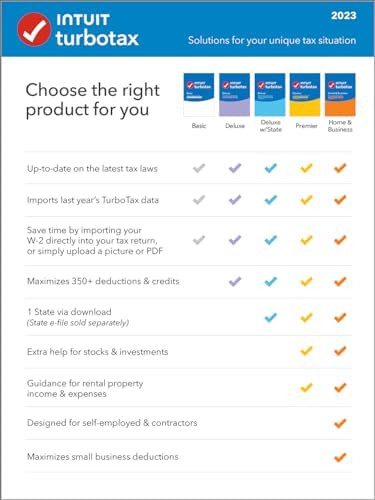

Discover the intuitive solution for managing your taxes with the **Intuit 2023 Home & Business Tax Software Download**. This software is specially designed for individuals and small business owners who need an efficient way to file taxes and maximize deductions. With intricate features tailored for both personal and business tax preparation, the Intuit Home & Business software stands out as a top choice for users seeking comprehensive tax solutions in 2023.

Key Features & Benefits

– **User-Friendly Interface**: The software boasts a clean layout, making navigation seamless for users of all skill levels. With step-by-step guidance, users can easily input their financial details without confusion.

– **Maximize Deductions**: TurboTax applies the latest tax rules to help you unlock every possible deduction. This software intelligently identifies business deductions, ensuring that you’re not leaving money on the table.

– **Digital Download**: Convenience is key with this software being available for instant download. Begin your tax preparation right after purchase and avoid shipping costs or delays.

– **System Compatibility**: The Intuit software is versatile. Compatible with both Windows 10 or later and macOS Monterey 12 or later, it ensures you can use it on various devices without hassle. The requirement of only 1 GB of disk space allows it to run smoothly on most computers.

– **Personalized Business Tax Reporting**: Tailored for small business owners, the software helps you report income and expenses accurately, ensuring compliance and efficiency in tax reporting.

– **Single User License**: Designed for one user, this software is perfect for sole proprietors or individuals seeking a straightforward tax solution without unnecessary complications.

Price Comparison Across Different Suppliers

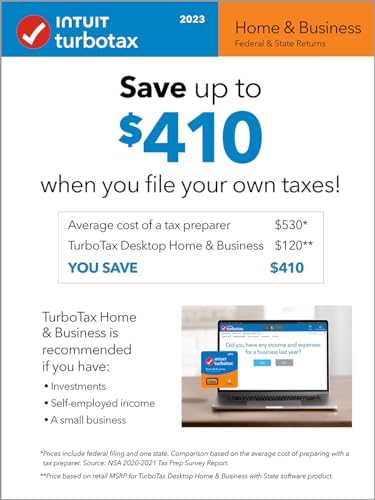

The Intuit 2023 Home & Business Tax Software offers competitive pricing across various online retailers. You can compare prices to ensure you receive the best deal. With the growing demand for tax software, prices can fluctuate, making it essential to review different platforms before making your purchase. According to recent data, users have noted that prices typically range around $90 to $120, depending on promotions and discounts available at specific stores.

6-Month Price History Insights

A look into the **6-month price history** chart reveals an interesting trend. Over the past half-year, there has been a slight increase in the price of Intuit’s tax software, correlating with the approach of tax season when demand rises. Observing these patterns can help users decide the optimal time to purchase, maximizing savings while minimizing stress during tax preparation.

Customer Reviews and Feedback

Customer reviews reflect a mix of positive and critical feedback. Many users praise the ease of use and comprehensive nature of the Intuit 2023 Home & Business Tax Software. They appreciate the ability to navigate complex tax situations with confidence and the high-quality customer support available.

However, some users have noted drawbacks such as limited support for older operating systems, with macOS Big Sur 11 not supported. Additionally, there are mentions of occasional software glitches, which can be frustrating during critical filing periods. Overall, the positive reviews outweigh the negatives, making this software a recommended choice for many.

Explore Video Reviews & Unboxings

If you’re still undecided, we encourage you to check out various **YouTube review and unboxing videos** showcasing the Intuit 2023 Home & Business Tax Software. These videos can provide a clearer understanding of the user experience and highlight specific features in action. Engaging with these resources can enhance your decision-making process.

Why Choose Intuit 2023 Home & Business Tax Software?

Choosing the **Intuit 2023 Home & Business Tax Software Download** means investing in a tax solution that prioritizes user experience and maximizes your financial benefits. Whether you are filing personal taxes or managing a small business, this software simplifies the complexities involved in tax preparation.

Don’t let the tax season stress you out. Utilize this powerful, user-friendly software to manage your finances effectively.

Compare prices now and take the first step toward a smoother tax filing experience!

Intuit 2023 Home & Business Tax Software Download Specification

Specification: Intuit 2023 Home & Business Tax Software Download

|

Intuit 2023 Home & Business Tax Software Download Reviews (4)

4 reviews for Intuit 2023 Home & Business Tax Software Download

Only logged in customers who have purchased this product may leave a review.

Zodoz –

5 stars as it is what is used to be once you take its new flaws, mainly the install process, but minus 1 star for the changes in made against the 2023 and older versions, and rating doesn’t rate the e-file process.

I’m a long time user, and was very concerned about the negative reviews late in 2023 for my staple tax program, how could those complaints be true, and how did Intuit go so wrong? There are some new things but passed it, it works the same as the old versions.

As of this review, I dl and installed and it was flawless. But, there was an unnerving gap during the installation when seemingly nothing happened as it didnt’ restart as normal, and there was no notification to click the icon to get it started. Clicking on the program icon got it started again; but this can throw non-computer people off.

The install and notification screens go far slower than previous, also unnerving as you don’t know what’s happened, but once complete, the program responds as in the past.

It requires registration on Intuit’s website now, which seems like a security issue, but Intuit is not alone in trying to use personal data beyond tax returns and has had issues with the FTC and class action, so caveat emptor. This has always been an issue until recent privacy laws, enacted only in the past 5 years or so, so I’ve used bogus personal information to generate a return, then manually edit the pdf to put the correct info before printing, which also allows me to proof the return in detail before submission.

For decades, I did not use e-file for security reasons so cannot comment on how it works today. The problems over the recent past confirm my skepticism about its security risks, including data breaches from the IRS itself. In the past 5 years or so, security from the IRS, and state gov’t have improved, there are more protection laws as well as safe guards against ID theft, but until e-file is mandatory for all, I use paper returns.

Digital Donkey –

TurboTax Home & Business 2023 Tax Software is a highly efficient and user-friendly solution for both personal and small business tax filing needs. It simplifies the tax filing process with its comprehensive features designed to cater to a wide range of tax situations, especially for self-employed individuals and small business owners.

One of the standout features of this software is its ability to handle industry-specific tax deductions, which can significantly boost the bottom line for small businesses. This tailored approach ensures that users can maximize their deductions and credits, leading to higher returns or lower tax liabilities.

The software includes five federal e-files and one state download, providing ample capacity for most users’ needs. However, it’s important to note that state e-files are sold separately, and any returns beyond the five free e-files must be printed and mailed. This package is particularly beneficial as it also offers free audit defense, a service valued at $60, which adds an extra layer of reassurance and support for users.

TurboTax Home & Business is not only up-to-date with the latest tax laws, ensuring compliance and accuracy, but it also allows for the import of information from previous years’ TurboTax returns or other tax software. This feature significantly reduces the time and effort involved in preparing taxes each year. Additionally, the software enables users to create and e-file W-2s and 1099s for employees and contractors, making it a comprehensive tool for managing all aspects of business taxation.

Available for both Windows and Mac operating systems, this software offers versatility and accessibility to a broad range of users. The digital download option, available through platforms like Amazon, further enhances the convenience by allowing immediate access to the software without the need for a physical disc.

TL;DR: TurboTax Home & Business 2023 Tax Software offers a robust, user-friendly solution for filing personal and small business tax. Its ability to handle industry-specific deductions and provide free federal e-files and a state download, along with features like audit defense and up-to-date tax law compliance, make it an invaluable tool for efficient and accurate tax preparation.

jonr –

I have used this software for 4 years now. An easy learning curve. A good software package for someone wanting to start a small business in their home but limited on funds. I may be moving up to a small business accounting software package that can integrate with this tax software. My experience is the cost is about half what tax accountant’s want for doing a small business’ taxes.

Mina –

TurboTax Home & Business 2023 Tax Software is an excellent choice for self-employed individuals and small business owners seeking accurate and hassle-free tax preparation. With its user-friendly interface and comprehensive features, it’s a valuable tool for navigating complex tax laws and maximizing refunds.

Pros:

– Easy to use, even for those without extensive tax knowledge

– Thorough guidance and explanations for each step

– Accurate calculations and error checking

– Supports multiple income sources, deductions, and credits

– Free U.S.-based product support

Cons:

– Pricing could be more competitive

– Some users may find the interface a bit cluttered

Overall, TurboTax Home & Business 2023 is a reliable and efficient solution for tax preparation. While it may not be the cheapest option, its accuracy and ease of use make it well worth the investment. If you’re looking for a stress-free tax filing experience, this software is an excellent choice.

Recommendation: If you’re self-employed or own a small business, TurboTax Home & Business 2023 is a great option. However, if you have simple tax returns, consider exploring more budget-friendly alternatives.